Consistent.

Reliable. Proven.

Your Monthly Income Stream Starts Here

Since 2013, Cannect Mortgage Investment Corporation has delivered a steady 8% average annualized return driven by conservative, well-structured mortgages for qualified Canadian borrowers. That’s over 12 years of consistent performance.

Return

Why Invest with Cannect MIC?

The Four Pillars Behind Our Consistent Returns

Direct-to-Consumer Lending

By lending directly to Canadian homeowners, we eliminate costly intermediaries. This allows us to offer lower rates to borrowers — while still generating strong, stable returns for our investors.

Direct-to-Investor Model

We raise capital without relying on third-party fund distributors. That means lower fees, more transparency, and better alignment between us and you, the investor.

Conservative Loan-to-Value Approach

We lend responsibly. By maintaining industry-low loan-to-value (LTV) ratios, we add a critical layer of protection to your investment — helping preserve capital and mitigate risk.

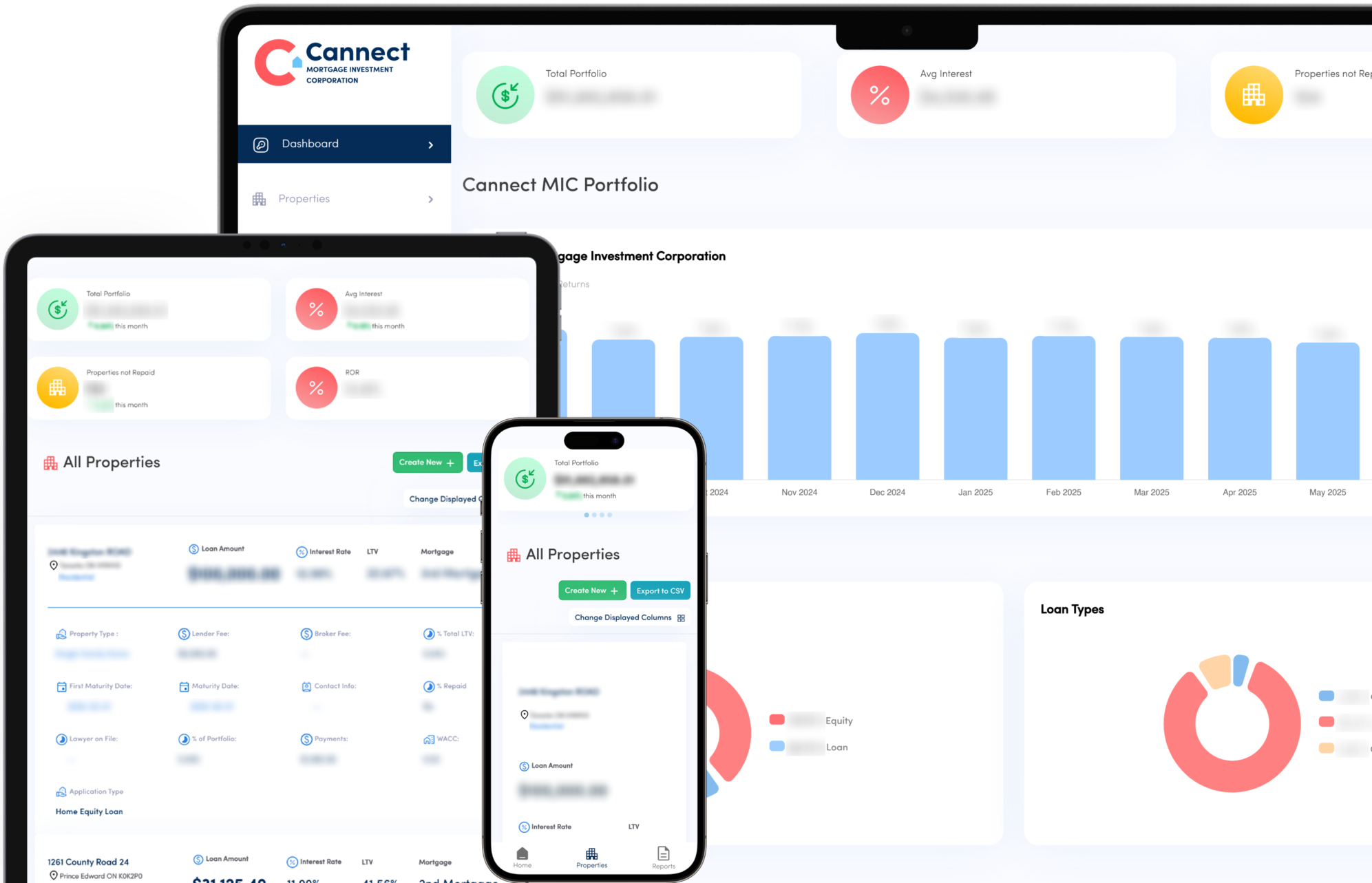

Technology-Driven Efficiency

Our in-house technology and automation streamline everything from borrower approvals to investor reporting. The result? Faster funding, greater oversight, and real-time transparency for all stakeholders.

Direct-to-Consumer Lending

By lending directly to Canadian homeowners, we eliminate costly intermediaries. This allows us to offer lower rates to borrowers — while still generating strong, stable returns for our investors.

Direct-to-Investor Model

We raise capital without relying on third-party fund distributors. That means lower fees, more transparency, and better alignment between us and you, the investor.

Conservative Loan-to-Value Approach

We lend responsibly. By maintaining industry-low loan-to-value (LTV) ratios, we add a critical layer of protection to your investment — helping preserve capital and mitigate risk.

Technology-Driven Efficiency

Our in-house technology and automation streamline everything from borrower approvals to investor reporting. The result? Faster funding, greater oversight, and real-time transparency for all stakeholders.

Who is This For?

Investors seeking

regular monthly

income

RRSP/TFSA/LIRA/

RESP/RRIF holders looking to diversify

Retirees prioritizing

stability and passive

returns

Professionals

wanting a smarter alternative to mutual funds and market swings

Have Questions?

Investing in Cannect Mortgage Investment Corporation means choosing a smarter alternative to traditional fixed-income products. Our portfolio is built on Canadian real estate and managed with a disciplined focus on capital preservation and consistent monthly returns — all with full transparency and investor-first oversight.

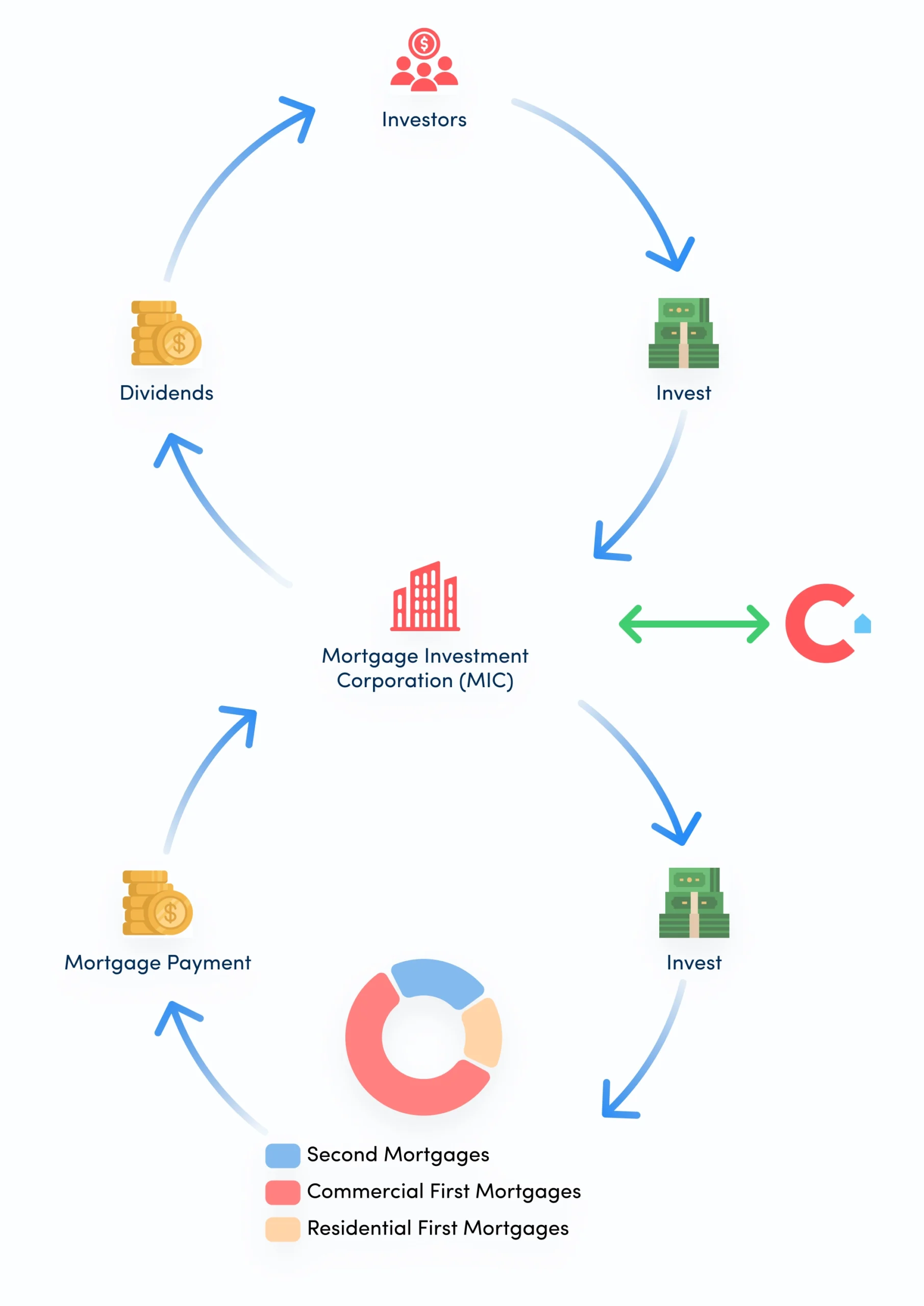

How It Works

Lending with Insight. Investing with Impact.

You Invest

Start with as little as $10,000.00 and become a shareholder in Cannect MIC through a TFSA, RRSP, RESP, RRIF, LIRA or non-registered investment account.

We Lend

To qualified borrowers with strong equity positions and viable exit strategies.

You Earn

Enjoy monthly dividends and the peace of mind that comes with a well-managed real estate-backed investment.

You Track

Access your robust, real-time dashboard anytime to track your investment performance with clarity and control.

Our Trusted Partners

Cannect works with Meadowbank to offer access to investors of all backgrounds. Established in 2006, Meadowbank Asset Management Inc is registered with the Ontario Securities Commission as a portfolio manager and exempt market dealer (EMD)

Central 1 Trust Company acts as trustee for Cannect Invest registered accounts, such as RRSPs, TFSAs, and more. Central 1 provides financial, digital banking, and payment services to over 250 financial institutions across Canada.

Hogg, Shain & Scheck is a boutique professional services firm providing audit, tax, and advisory services to not-for-profits, corporations, and entrepreneurs in the GTA and across southern Ontario for over 43 years. Through our exceptionally high quality, insightful, and personalized service, we are devoted to helping our clients thriv

The Portal Experience

Your Investment Dashboard

Real-time performance, monthly payouts, downloadable reports, account history, and full visibility — all in one secure, easy-to-use dashboard.

Understand Before You

Invest

4 minute read

4 minute read

4 minute read

Testimonials

See What Our Investors Are Saying

“We’ve been with Cannect for nearly 10 years, and the stability and safety of our investment have been rock-solid. The monthly returns are consistent, and with Marcus and the team, we know our money is protected—no matter what the market does. Stable, positive returns? You can’t beat that. We recommend Cannect 110%.”

Kris & Christine

Cannect MIC Investor

“We’ve been with Cannect for nearly 10 years, and the stability and safety of our investment have been rock-solid. The monthly returns are consistent, and with Marcus and the team, we know our money is protected—no matter what the market does. Stable, positive returns? You can’t beat that. We recommend Cannect 110%.”

Phil

Cannect MIC Investor

“We’ve been with Cannect for nearly 10 years, and the stability and safety of our investment have been rock-solid. The monthly returns are consistent, and with Marcus and the team, we know our money is protected—no matter what the market does. Stable, positive returns? You can’t beat that. We recommend Cannect 110%.”

Nicolina

Cannect MIC Investor

Aligned Interests.

Shared Success.

Total Transparency.

We treat your investment like our own. Our executive team is personally invested in Cannect MIC, and we provide regular updates, audited financials, and open communication, always.

More than

1K+ Investors

Frequently Asked

Questions

What’s the minimum investment amount?

The minimum to get started is $10,000. You can add more later if you choose, and many investors do once they’re comfortable.

Is Cannect MIC regulated?

The minimum to get started is $10,000. You can add more later if you choose, and many investors do once they’re comfortable.

What happens if a borrower doesn’t pay?

The minimum to get started is $10,000. You can add more later if you choose, and many investors do once they’re comfortable.

How are monthly returns paid out?

The minimum to get started is $10,000. You can add more later if you choose, and many investors do once they’re comfortable.

How do I access my investor portal?

The minimum to get started is $10,000. You can add more later if you choose, and many investors do once they’re comfortable.

Is this investment risky?

The minimum to get started is $10,000. You can add more later if you choose, and many investors do once they’re comfortable.

How long is my money locked in?

The minimum to get started is $10,000. You can add more later if you choose, and many investors do once they’re comfortable.

What’s the minimum investment amount?

The minimum to get started is $10,000. You can add more later if you choose, and many investors do once they’re comfortable.

Can I use RRSPs or TFSAs?

The minimum to get started is $10,000. You can add more later if you choose, and many investors do once they’re comfortable.

Have

Questions?

Considering Cannect MIC then we’ll give clear, no‑jargon answers about how it works, risks/fees, and help set up an account only if you want.